Choosing the right trading platform can shape a trader’s success. This Australian-based broker provides two distinct options: Standard and Raw. Both cater to different strategies, whether you’re a casual investor or an active professional.

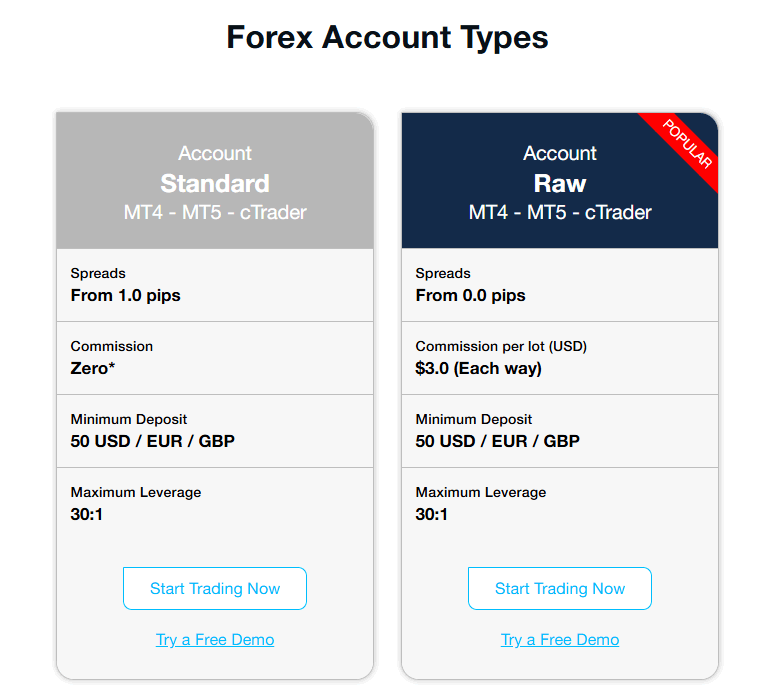

The Standard option features commission-free trades with spreads starting at 1.0 pips. Ideal for beginners, it requires a $100 minimum deposit. Meanwhile, the Raw plan offers spreads from 0.0 pips but charges $6 per round lot. This makes it up to 66% cheaper for high-volume traders.

Both choices support leverage up to 1:500 and allow algorithmic or copy trading. Despite identical tools, their pricing structures attract different audiences. Frequent traders often prefer Raw for lower long-term costs, while Standard suits those prioritizing simplicity.

Understanding these differences helps optimize profitability. Whether you focus on forex, indices, or commodities, selecting the right plan ensures costs align with your strategy.

Overview of FP Markets Account Types for Trading

Trusted by active investors since 2005, this Sydney-based brokerage combines strict regulation with diverse financial instruments. Operating across six jurisdictions, it maintains licenses from top-tier authorities like ASIC and CySEC. These certifications ensure segregated client funds and transparent trading practices.

Company Background and Global Reach

With headquarters in Australia, the firm serves clients in over 100 countries through localized support teams. Multiple regulatory approvals let traders operate in key regions like Europe, Africa, and the Middle East. This international presence enables consistent access to markets during volatile conditions.

Range of Trading Options Offered

Clients trade 60+ currency pairs alongside commodities like crude oil and gold. Equity enthusiasts access 10,000+ CFDs covering NYSE, NASDAQ, and global indices. Key features include:

- ECN/STP execution on upgraded MT4 & MT5 platforms

- 42 deposit currencies via 22 payment processors

- 11 base currency options for reduced conversion fees

Automation-friendly interfaces support both manual strategies and algorithmic systems. Such flexibility makes the service suitable for scalpers, position traders, and portfolio managers alike.

Understanding the Standard and Raw Accounts

Effective trading hinges on aligning costs with strategy execution. The two primary options cater to distinct approaches: one prioritizes simplicity, while the other rewards volume. Deciding between them depends on how often positions open and close.

Standard Account Features and Benefits

The Standard model eliminates per-trade commissions, embedding costs within spreads starting at 1.0 pips. For a EUR/USD trade, this translates to roughly $10 per standard lot. This structure suits those executing fewer trades monthly, offering predictable expenses without surprise fees.

Minimum deposits begin at $100, making it accessible for newcomers. Swap-free Islamic versions replace overnight fees with fixed administrative charges, adhering to Sharia principles. Shared features like 1:500 leverage and 0.01-lot micro trades let users manage risk effectively.

Key Advantages of the Raw Account

Active traders save significantly with the Raw option. Spreads drop to 0.0 pips on major pairs, paired with $3 commissions per lot per side. Frequent scalpers or algorithmic systems benefit most, as lower spreads reduce entry/exit friction.

High-volume strategies become 66% cheaper compared to Standard pricing. Like its counterpart, this plan supports Expert Advisors and offers swap-free adjustments. The combination of tight spreads and transparent fees creates ideal conditions for rapid-fire trading styles.

Trading Platforms and Execution Models

Selecting optimal software tools determines how effectively traders execute strategies. Two industry-standard platforms dominate this space, each catering to specific needs. Understanding their technical capabilities helps users align choices with their preferred assets and methods.

MT4 and MT5: Features and Differences

MetaTrader 4 remains the go-to platform for forex specialists. Its streamlined interface supports 9 timeframes and MQL4 scripting for basic automated systems. Over 10,000 custom indicators exist within its ecosystem, ideal for manual analysis.

MT5 expands capabilities with 21 timeframes and 6 pending order types. It handles stocks, futures, and bonds alongside forex – perfect for diversified portfolios. The MQL5 language enables complex algorithms, while Depth of Market displays real-time liquidity for precision entries.

ECN Versus Market Maker Execution

Standard users benefit from hybrid execution blending ECN pricing with market maker speed. Orders fill instantly without requotes, crucial during volatile sessions. This model suits casual traders prioritizing reliability over raw spread tightness.

Raw account holders access true ECN execution with 0.0 pip spreads. Direct market routing eliminates conflicts of interest, favored by scalpers and algorithmic systems. Both platforms deliver under 40ms execution speeds, maintaining competitiveness across global markets.

Traders choosing MT4 gain simplicity for currency-focused strategies. MT5 users unlock advanced tools for multi-asset portfolios. Matching platform strengths to individual needs ensures optimal trade execution.

Comparing Trading Costs and Conditions

Understanding cost dynamics transforms trading outcomes. Both plans require a $100 minimum deposit, but their fee structures diverge sharply. This analysis reveals which option saves money based on activity levels.

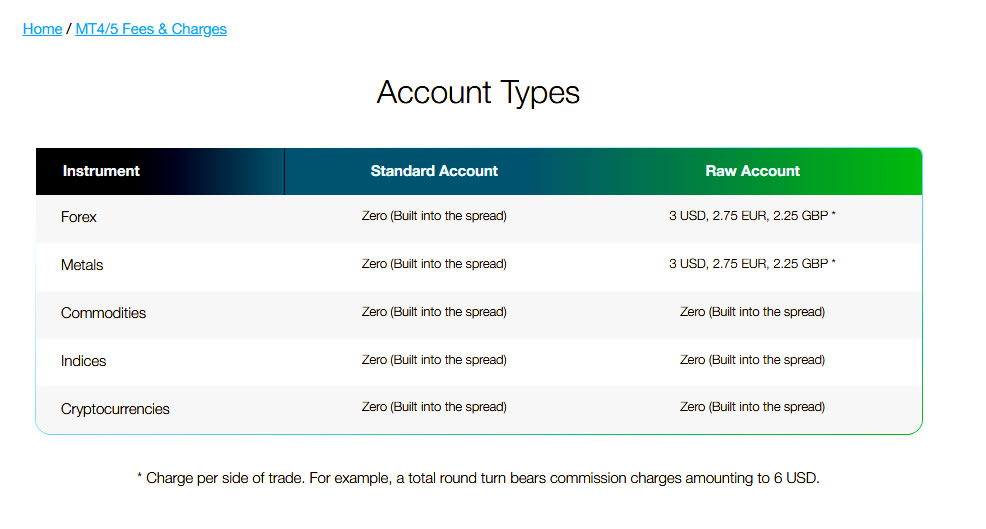

Commission Structures and Costs

The Standard plan embeds fees within spreads starting at 1.0 pips. For a 1-lot EUR/USD trade, this equals roughly $10. No extra charges apply, making budgeting straightforward for casual traders.

The Raw alternative uses razor-thin 0.0 pip spreads but adds $3 per side commissions. High-volume strategies benefit here:

- 10 lots daily = $60 savings vs Standard

- 50+ lots monthly = 66% lower costs

- Breakeven at 15+ trades/month

Spread Variations and Leverage Options

Spreads fluctuate with market volatility. Major pairs like GBP/USD show the starkest differences – 1.2 pips average on Standard versus 0.2 pips on Raw. Scalpers gain immediate advantages from tighter spreads during rapid entries.

Both accounts offer 1:500 leverage, letting traders control $50,000 positions with $100. This identical risk profile allows strategy consistency across plans. Eleven base currencies reduce conversion fees – holding USD balances avoids extra charges when trading dollar pairs.

Frequent traders typically prefer Raw’s transparent pricing. Occasional investors often stick with Standard’s simplicity. Matching cost structures to trade frequency optimizes profitability.

Live Trading Account Considerations vs Demo Accounts

Mastering the shift from practice to real trading separates successful traders from the rest. While demo tools help build skills, live environments reveal how strategies perform under pressure. This transition demands careful planning to avoid costly mistakes.

Benefits of Opening a Live Trading Account

Real-money trading sharpens decision-making through genuine market dynamics. Traders experience true slippage, order execution delays, and emotional responses absent in simulations. These factors test discipline, revealing whether strategies hold under stress.

- Authentic psychology: Fear and greed influence real trades

- Accurate cost tracking: Fees and spreads impact actual profits

- Risk awareness: Losses motivate better money management

Limitations of Demo Accounts for Realistic Trading

Simulated environments often create overconfidence. Without financial stakes, traders may take reckless risks or ignore proper analysis. Key gaps include:

- Emotional detachment: No consequences for poor decisions

- Idealized liquidity: Demo fills sometimes differ from live markets

- Strategy overfitting: Systems optimized for historical data may fail

Algorithm developers should test bots in both modes before deployment. Start live trading with small positions – $500 balances let you practice risk management without excessive exposure.

Adapting Trading Strategies with FP Markets

Tailoring approaches to market conditions separates consistent performers from occasional participants. Advanced tools like algorithmic systems and copy trading services help traders refine their methods. Both Standard and Raw plans provide infrastructure to execute diverse strategies efficiently.

Utilizing Algorithmic and Copy Trading Options

Automated systems thrive on the Raw plan’s tight spreads and rapid execution. Expert Advisors process signals faster with under 40ms latency, capturing fleeting opportunities in forex trading. Key benefits include:

- Cost efficiency: $3 commissions per lot suit high-frequency algorithms

- VPS hosting: Minimizes delays for round-the-clock strategies

- Copy trading: Mirror top performers’ moves across 60+ currency pairs

The Standard option accommodates simpler bots with predictable spread-based costs. MAM/PAMM tools let managers oversee multiple portfolios seamlessly.

Insights for Scalpers and High-Frequency Traders

Scalpers need razor-thin spreads to profit from micro price shifts. The Raw plan delivers 0.0 pip starting spreads on majors like EUR/USD, slashing entry costs by 66% versus Standard pricing. Three factors make it ideal:

- ECN execution eliminates requotes during volatile sessions

- 1:500 leverage amplifies small position gains

- 11 base currencies reduce conversion fees

High-volume traders executing 50+ lots monthly maximize savings. Pairing Raw’s structure with MT5’s Depth of Market display creates a competitive edge for rapid trades.

In-Depth Look at fp markets account types: Standard vs Raw

Selecting between Standard and Raw trading plans requires matching personal habits to pricing models. Each option serves distinct trader profiles based on frequency, budget, and preferred assets. This final analysis clarifies which users gain maximum value from either structure.

Who Should Choose Which Plan?

The Standard plan suits casual traders executing fewer than 15 monthly lots. Its commission-free model simplifies budgeting for those prioritizing ease over ultra-low spreads. Beginners appreciate the $100 entry point and stable 1.0 pip spreads during volatile hours.

High-volume specialists thrive with the Raw plan. Tight 0.0 pip spreads slash entry costs for scalpers opening 50+ positions weekly. Algorithmic systems benefit from $3 per-lot fees, which become negligible across hundreds of trades. Active forex traders save 66% versus Standard pricing.

Cost Efficiency and Trading Strategies

Spread-focused strategies align best with Raw’s structure. Day traders capturing micro price movements gain immediate advantages from near-zero spreads on EUR/USD or GBP/JPY. Conversely, long-term investors holding positions for days prefer Standard’s predictable all-in costs.

Breakeven analysis shows Raw becomes cheaper after 15+ round-turn trades monthly. Match your plan to execution frequency: occasional traders overspend with Raw, while active users waste funds on Standard’s wider spreads.