Online trading platforms face intense scrutiny from users, and IC Markets is no exception. With a Trust Score of 84/100 from ForexBrokers.com, this broker has built a reputation since its 2007 launch. Regulated by ASIC and Cyprus authorities via MiFID standards, it appeals to traders prioritizing security.

Customer feedback reveals a split perspective. Many praise competitive spreads and rapid trade execution, calling it ideal for active strategies. Others highlight frustrations with withdrawal delays and inconsistent support. One user noted, “The platform works smoothly, but resolving issues takes too long.”

This analysis digs into verified testimonials to separate hype from reality. While some traders report seamless experiences, others cite challenges with account management. The mix of reviews underscores the importance of understanding both strengths and weaknesses before committing funds.

By evaluating regulatory compliance, pricing models, and user-reported outcomes, this review provides a balanced look at what to expect. Whether you’re new to trading or refining your strategy, real-world insights matter.

Understanding the IC Markets Platform

Modern traders demand versatile tools to navigate fast-moving financial markets. This section explores the core features that power one of the industry’s most discussed brokerage platforms.

Diverse Trading Instruments

The platform provides access to 3,583 financial instruments, including:

- 60+ currency pairs (major, minor, exotics)

- Commodities like gold, oil, and agricultural products

- Global stock indices and cryptocurrency CFDs

Such variety enables strategies across asset classes, from short-term forex trades to long-term commodity positions.

Cutting-Edge Infrastructure

Servers in New York and London data centers ensure execution speeds under 1 millisecond for most trades. This technological edge supports:

- High-frequency algorithmic trading

- Scalping strategies requiring instant order fills

- Global access across 200,000+ client accounts

With $1.39 trillion in monthly volume, the platform handles intense market activity while maintaining stability. Regulatory oversight from multiple jurisdictions adds credibility to these services.

Examining ic markets trustpilot Customer Feedback

Evaluating client feedback reveals both strengths and weaknesses of trading services. Trustpilot reviews for this broker showcase polarized experiences, with some users celebrating seamless operations while others face persistent challenges. This split underscores the importance of scrutinizing real-world accounts before committing funds.

What Users Say About Their Trading Experiences

Positive reviews frequently highlight:

- Tight spreads across forex and CFD instruments

- Lightning-fast order execution under 1ms

- Multiple platform options catering to different strategies

One trader noted, “The variety of tools supports everything from scalping to long-term positions.” However, recurring complaints focus on financial accessibility. Nearly 18% of negative feedback cites frozen accounts during mandatory reviews, with some users waiting weeks for resolution.

Analysis of Positive and Negative Reviews

Patterns emerge when examining review clusters. Praise often relates to technical performance:

- Reliable infrastructure handling high trading volumes

- Competitive pricing for active traders

- Advanced charting packages

Criticism frequently targets operational processes. Common issues include withdrawal delays exceeding advertised timelines and unannounced account verification holds. Long-term clients report diminishing satisfaction, particularly when withdrawing profits. One user stated, “What began as smooth sailing became a bureaucratic nightmare after three years.”

IC Markets’ Regulatory Landscape

Jurisdictional oversight varies significantly across global trading platforms. This broker maintains licenses from multiple authorities, creating a patchwork of protections for different client groups.

Tiered Oversight Systems Explained

The company holds Tier-1 regulation through Australia’s ASIC and Cyprus’ MiFID framework. These jurisdictions require:

- Segregated client funds in protected trust accounts

- Regular financial audits and capital adequacy checks

- Compensation schemes up to €20,000 for European traders

However, many accounts now operate under Seychelles oversight (Tier-4). This shift removes mandatory compensation funds and reduces capital requirements. Traders should verify their account’s governing entity during registration.

UK Trader Considerations

British clients face unique challenges since the platform withdrew from FCA regulation. Key impacts include:

- No Financial Services Compensation Scheme coverage

- Limited dispute resolution avenues

- Potential fund accessibility delays during audits

One London-based trader reported: “Withdrawals took three weeks during compliance checks – something that rarely happened under FCA oversight.” While ASIC-regulated accounts offer stronger safeguards, most UK clients get routed to lower-tier entities.

Trading Platforms and Account Types

Choosing the right combination of trading software and account structure shapes every investor’s experience. This section breaks down key options for executing strategies across devices.

MetaTrader, cTrader, and TradingView Options

Three dominant platforms cater to different needs. MetaTrader 4 remains popular for automated strategies through Expert Advisors, while MT5 adds stock trading and advanced charting. Professional traders often prefer cTrader’s depth-of-market displays and granular order controls.

TradingView integration bridges technical analysis gaps, offering 12 chart types and social trading insights. Though powerful, some users report occasional freezing during volatile markets.

Overview of Standard, Raw Spread, and cTrader Accounts

Account selection directly impacts costs. The Standard account uses spread-only pricing (1.0 pips on EUR/USD), ideal for casual traders. Active users typically choose Raw Spread accounts, paying $7 commissions for 0.1 pip spreads.

The cTrader Raw Spread variant charges $6 per lot with tighter pricing still. A 2025 industry award recognized these trading solutions as top MetaTrader providers, though mobile execution sometimes lags desktop performance.

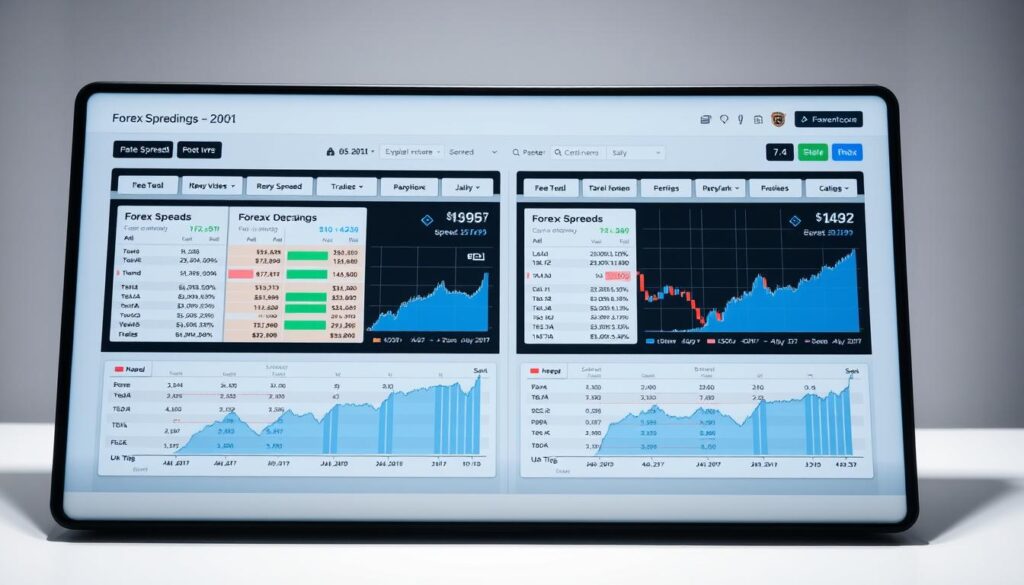

Competitive Pricing, Spreads, and Fees

Cost efficiency separates successful traders from those struggling to turn profits. This broker positions itself as a low-cost leader, but real-world performance depends on strategy and market conditions.

Commission Structures and Trading Costs

The platform offers three pricing models. cTrader accounts show 0.62 pip total costs for EUR/USD, while MetaTrader Raw Spread users pay 0.72 pips after $7 commissions. The Standard account skips fees but uses wider 0.62 pip spreads.

Active traders gain advantages through volume discounts. Executing 100+ lots monthly reduces costs significantly. However, some users report spreads widening beyond advertised levels during news events.

Comparisons with Other Forex Brokers

Key differentiators include:

- $200 minimum deposit – lower than many competitors

- Institutional-grade pricing for retail traders

- Multi-platform fee structures

While headline rates beat most brokers, hidden costs sometimes emerge. Traders mention unexpected swap fees and complex commission calculations. One user noted: “My effective spread doubled during the Brexit announcement despite ‘stable’ pricing claims.”

For UK-based traders, currency conversion fees add another layer. USD-denominated accounts avoid this, but GBP users face extra charges during volatile periods.

Mobile Trading Options and Tools

The rise of smartphones has transformed how investors interact with financial markets, demanding tools that keep pace with their mobile lifestyles. While desktop platforms remain essential for complex strategies, handheld access bridges gaps between market movements and real-time reactions.

Features of the IC Markets Mobile App

Third-party apps for MetaTrader, cTrader, and TradingView deliver core functionality for iOS and Android users. Traders can execute manual orders, adjust stop-loss levels, and monitor open positions through streamlined interfaces. Basic charting tools with 9 timeframes help spot trends during commutes or breaks.

Automated strategies remain desktop-exclusive, limiting mobile users to reactive decision-making. Copy trading integrations through ZuluTrade and IC Social enable mirroring expert traders, though setup requires separate app downloads. Some users report occasional sync delays between mobile and desktop dashboards.

Benefits for On-The-Go Traders

Real-time market access proves invaluable during volatile periods. A London-based day trader shared: “Closing trades from my phone saved me £2k when oil prices suddenly dropped.” Instant notifications for price alerts and margin calls add layers of risk management.

However, advanced technical indicators and multi-screen layouts stay restricted to computer versions. While mobile platforms handle routine tasks efficiently, complex analysis demands switching devices. Customer support confirms most mobile issues stem from outdated app versions rather than server-side flaws.

For casual investors and position monitors, these tools deliver sufficient capability. High-frequency trading enthusiasts may find the mobile experience lacking depth compared to specialized competitors.

Research and Educational Resources

Knowledge fuels success in financial markets, yet finding reliable guidance remains challenging. This broker combines original content with third-party insights to help traders navigate currency fluctuations and global events.

Daily Market Commentary and Technical Analysis

Subscribers receive morning briefings covering forex pairs, commodities, and indices. The IC Your Trade video series breaks down chart patterns and economic indicators, with actionable ideas for day trading strategies. Updated charts track support/resistance levels across 28 major assets.

Guides, Webinars, and Learning Series

Six educational series offer step-by-step tutorials:

- Basics of CFD trading and risk management

- Advanced technical analysis techniques

- Leveraging Trading Central’s algorithmic signals

While the library includes 100+ articles, users report difficulty finding materials matching their skill level. Autochartist integration provides automated trade setups, but beginners often need external courses for foundational knowledge.

Live webinars focus on current market conditions rather than structured skill-building. UK traders appreciate GBP-specific sessions, though archived recordings lack search filters. Mobile users can access most content, but interactive quizzes or progress tracking remain absent.

Algorithmic Trading and Social Copy Platforms

Automation reshapes trading strategies by merging speed with social insights. Advanced tools now let traders deploy algorithms or mirror proven strategies across global markets. This dual approach caters to both tech-savvy developers and those seeking collaborative opportunities.

Automated Trading Capabilities and VPS Services

The platform supports three automation solutions:

- MetaTrader Expert Advisors for custom scripts

- cTrader cAlgo for advanced backtesting

- TradingView Pine Script integrations

Free Virtual Private Server access activates after trading 15 standard lots monthly. These servers slash latency to 0.4ms – crucial for scalping strategies. One London-based developer noted: “My arbitrage bot executes 12% faster using their VPS compared to local hosting.”

Insights into Social Copy Trading

Five copy trading channels let users replicate expert moves:

- cTrader Copy for real-time position mirroring

- MetaTrader Signals with performance analytics

- IC Social’s mobile-first interface

The new IC Social app simplifies following top traders through swipe gestures. However, some users report delayed execution during peak hours compared to desktop platforms. A 2024 test showed 0.8-second lag times when copying 10+ trades simultaneously.

While automated trading excels in speed, human oversight remains vital. One algorithmic trader warned: “My EA triggered 47 unintended trades during sudden volatility spikes.” Balancing automation with manual checks appears critical for consistent results.

Customer Support and Service Quality

Effective customer support remains a cornerstone of successful trading experiences. Traders require accessible channels and swift resolutions when managing positions or navigating platform features. Available options include 24/5 live chat, email ticketing, and phone assistance—each catering to different urgency levels.

Response Efficiency Across Support Channels

Live chat typically delivers answers within 90 seconds during market hours, according to recent user reports. Email queries often take 6-8 business hours for detailed responses. Some clients note longer wait time during volatile periods when inquiry volumes spike.

The support team’s expertise varies by complexity. Basic account questions get resolved quickly, while technical or withdrawal issues may involve multiple departments. One user shared: “My withdrawal process took three days after providing requested documents—faster than some brokers but slower than promised.”

Continuous service improvements show in expanded training programs and weekend coverage trials. However, consistency remains a challenge. Traders recommend having backup communication methods during critical situations. Clear escalation paths for unresolved issues could further enhance client trust in operational reliability.