Since its launch in 2004, Forex Factory has become a cornerstone for currency market participants. This platform connects traders globally through real-time economic data, analytical tools, and collaborative forums. Its evolution mirrors the growth of online trading, adapting to serve both seasoned professionals and those taking their first steps in forex.

The site’s core mission centers on democratizing market insights. Traders access critical resources like live economic calendars, volatility analysis, and strategy discussions—all in one place. Unlike fragmented alternatives, it eliminates the need to juggle multiple sources for actionable intelligence.

Transparency remains a priority. Every feature, from trade journal templates to broker comparisons, is designed to level the playing field. Whether analyzing GBP/USD trends or navigating Brexit-related fluctuations, users gain tools to make informed decisions regardless of account size or location.

By merging community-driven knowledge with institutional-grade data streams, Forex Factory creates a unique ecosystem. It’s not just a hub for charts and news—it’s where market narratives take shape through shared expertise.

Introduction to the Forex Factory Platform

What began as a modest forum in 2004 evolved into a multi-tool hub for currency enthusiasts. Early versions focused on connecting traders through threaded discussions, but user demand sparked rapid innovation.

Overview of the Platform’s Evolution

The shift from basic forums to integrated tools marked a turning point. Real-time economic calendars arrived in 2009, followed by volatility indicators and broker comparison charts. Three upgrades defined its growth:

- Automated news filtering (2012)

- Customizable API feeds (2015)

- Mobile-responsive design (2018)

These changes transformed how professionals access market-moving data, while beginners gained clearer entry points into complex topics.

Benefits for Beginners and Professionals

Newcomers find simplified chart overlays and glossary terms that explain jargon like “pip” or “leverage.” Mentorship thrives in strategy-sharing threads where veterans dissect trades step-by-step.

Seasoned users leverage advanced filters to isolate high-impact events or backtest strategies against historical patterns. The platform’s design ensures a hedge fund manager and a part-time trader both extract value without overwhelming interfaces.

Shared trade journals create a feedback loop—novices learn risk management tactics, while experts spot emerging market trends through crowd-sourced insights.

How to Navigate the forexfactory website

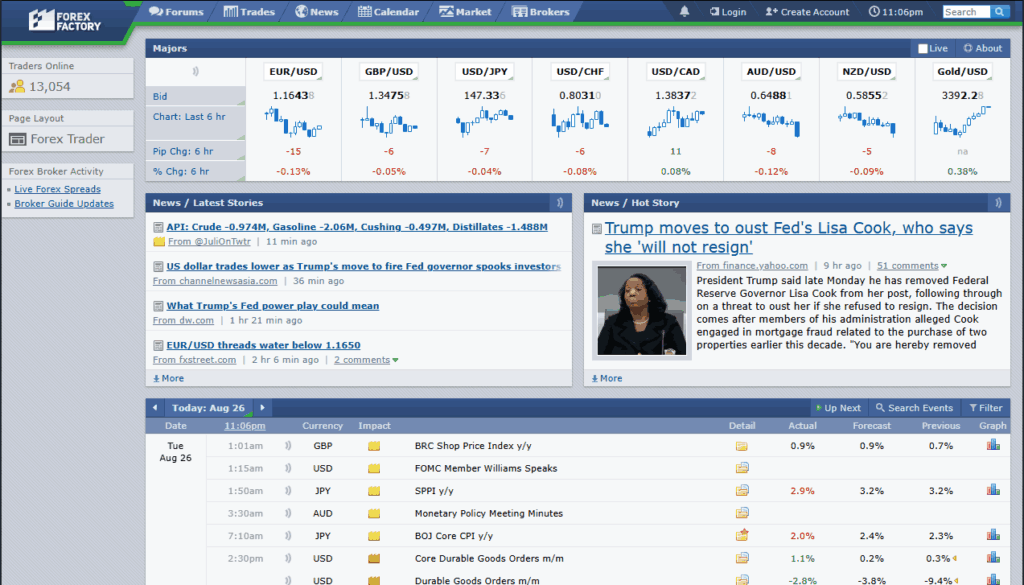

Mastering the layout of this trading hub streamlines access to critical market tools. The platform organizes its features into clear sections, from real-time news feeds to interactive forums.

Key areas like the Economic Calendar dominate the top menu, while community discussions thrive under the Forums tab. Users can jump between market analysis threads and broker comparisons with two clicks. Customization elevates the experience—drag-and-drop widgets let users prioritize data streams they use most.

Personal dashboards remember layout preferences across devices, ensuring seamless transitions from desktop to mobile. The Scanner section delivers live price alerts, while the Calendar Box highlights high-impact events. Whether researching strategies or tracking GBP volatility, every tool remains within quick access.

Advanced options include filtered views for specific asset classes or regional economic updates. First-time visitors benefit from tutorial pop-ups explaining each section’s purpose. This thoughtful design means both casual traders and full-time analysts find value without navigation headaches.

Setting Up Your Account and Registration Process

Establishing a profile unlocks tailored trading resources on Forex Factory. The streamlined process takes under two minutes, granting immediate access to customized tools. Registration ensures your preferences shape how you interact with market data and community insights.

Steps to Create Your Profile

Begin by visiting the platform’s homepage and selecting the Join button. Follow these three steps:

- Enter your email address and create a secure password

- Select your country from the dropdown menu

- Agree to the terms of service

Confirmation arrives instantly, letting users log in immediately. This initial setup forms the foundation for personalizing your trading environment.

Personalizing Your Preferences

After registration, dive into settings to refine your experience. Key customization options include:

- Dashboard layout adjustments

- Local time zone synchronization

- Event alert thresholds

These preferences carry across devices, ensuring consistent access to critical data. Traders can later modify these settings as their strategies evolve.

Completing your profile elevates functionality through features like Trade Explorer integration and advanced forum participation. The platform remembers your chosen configurations, creating a frictionless environment for both analysis and community engagement.

Leveraging the Forex Factory Economic Calendar

Market-moving data drives currency valuations daily. The platform’s economic calendar transforms raw numbers into actionable strategies. Traders track everything from inflation reports to central bank decisions through this dynamic tool.

Understanding Economic Events and Impact Levels

Color codes simplify prioritization. Red marks high-impact events like US Non-Farm Payrolls—these often trigger 100+ pip swings. Orange indicates medium volatility, such as Eurozone retail sales. Yellow flags low-impact updates like minor commodity reports.

- Red: Prep for rapid price shifts

- Orange: Monitor related currency pairs

- Yellow: Use for long-term trend analysis

GBP/USD traders, for example, focus on red UK inflation data. The actual vs. forecast deviation determines trade direction. Historical charts show how past releases moved markets.

Customizing Calendar Views for Local Time

Sync the factory calendar to your time zone in three steps:

- Click settings above the calendar grid

- Select your region from the dropdown

- Save preferences

Filter by currency pairs or impact levels to hide noise. A EUR-focused trader might hide Asian events, while day traders exclude yellow alerts. This laser focus prevents analysis paralysis during busy news weeks.

Real-time updates ensure you never miss critical releases. Combine filtered views with price alerts to capitalize on volatility spikes efficiently.

Configuring Time Zones and Event Filters

Accurate timing separates reactive traders from proactive strategists. Proper time zone alignment ensures economic events display in local hours, eliminating guesswork during volatile market openings. This adjustment prevents missed entries or exits caused by mismatched schedules.

Adjusting Time Settings for Accuracy

Follow these steps to sync the calendar with your location:

- Navigate to the platform’s economic calendar

- Click the clock icon in the top toolbar

- Select your region from the dropdown menu

Enable Daylight Saving Time adjustments if applicable. Choose between 12-hour or military formats based on personal preference—consistency reduces interpretation errors during fast-moving events.

Advanced filter options let traders hide irrelevant data. Focus on specific currencies or impact levels using these tools:

- Exclude low-volatility announcements

- Highlight central bank speeches

- Isolate GBP/EUR-related updates

Saved settings apply across devices, ensuring seamless time management. Traders no longer waste minutes recalculating time differences or sifting through unimportant alerts.

Utilizing Scanner and Market Data Tools

Real-time market insights empower traders to act decisively. The platform’s scanner transforms raw data into visual dashboards, highlighting critical movements across currency pairs. Users customize feeds to track preferred instruments, filtering noise from actionable signals.

Live Price Feeds and Data Interpretation

The scanner’s price alert system notifies users when EUR/USD or GBP/JPY hit predefined levels. Three steps to configure alerts:

- Select desired currency pairs

- Set threshold values or percentage changes

- Choose notification methods (email, pop-up)

True Pricer technology aggregates data from 50+ brokers, reducing discrepancies in bid-ask spreads. This ensures traders see consensus price levels rather than single-source quotes. Overlay technical indicators like RSI or MACD directly on live charts for instant analysis.

Historical data archives let traders backtest strategies against past market reactions. Study how USD/CAD behaved during oil inventory reports or how Brexit votes impacted GBP volatility. These insights sharpen decision-making during high-impact trading sessions.

Custom watchlists streamline monitoring. Group major forex market instruments with commodities or indices for cross-asset correlations. Adjust timeframes from one-minute ticks to weekly trends—all within a single interface designed for speed and precision.

Engaging with Forums and Trading Communities

Trading thrives on shared knowledge, and the platform’s forums act as a global classroom for currency enthusiasts. Here, traders dissect market movements, debate strategies, and troubleshoot challenges in real time. Diverse perspectives collide—retirees share wisdom alongside hedge fund analysts, creating a unique melting pot of insights.

Participating in Discussions

Quality contributions fuel these communities. Start by asking specific questions like “How does the ECB’s inflation target affect EUR/CHF?” rather than vague prompts. Use the like system to boost helpful answers—posts with high engagement appear at thread tops, saving time during research.

Key discussion categories include:

- Algorithmic trading backtests

- Psychology during drawdowns

- Risk-reward ratio calculations

Avoid heated debates—focus on factual exchanges. The dislike feature helps filter unproductive comments without personal attacks.

Sharing and Learning from Peer Insights

Veterans often post annotated charts showing entry/exit logic. Newcomers gain clarity by studying these visual guides. One London-based trader recently shared a GBP volatility playbook that became a sticky thread for its actionable steps.

Three rules for effective knowledge exchange:

- Credit original strategy creators

- Use spoiler tags for lengthy code snippets

- Verify data sources before sharing

These forums transform isolated trading into collaborative growth. By contributing regularly, users build reputations that open doors to private groups and beta tools.

Implementing Practical Trading Strategies

Sharp traders know economic news moves markets, but smart ones let the dust settle first. Effective trading strategies balance anticipation with patience—especially around high-impact events. This approach minimizes guesswork while maximizing data-driven decisions.

Strategies Based on Economic News

Major announcements like interest rate changes often trigger rapid price swings. Three rules govern news-based strategies:

- Close positions 24 hours before red-calendar events

- Analyze post-news price patterns for clearer signals

- Use trailing stops instead of fixed profit targets

For example, EUR/USD might dip initially after strong US jobs data, then rebound as markets digest the report. The economic calendar helps identify these opportunities—study reactions from past events to spot recurring trends.

Risk Management and Trade Timing

Protecting capital trumps chasing profits during volatility spikes. Adjust position sizes based on event impact levels:

- High-risk events: 1% account exposure

- Medium impact: 2-3% allocation

- Low volatility: Standard 5% risk

Exit partial profits before news releases if holding positions. Set stop-loss orders beyond recent swing highs/lows to avoid false breakouts. Combine these tactics with forex technical indicators like support zones for stronger trade setups.

Successful trading isn’t about predicting news—it’s about reacting strategically once markets stabilize. Tools like Forex Factory’s volatility charts help identify optimal re-entry points after initial price reactions fade.

Exploring Trades, Leaderboards, and Trade Explorer Features

Transparency in trading decisions becomes tangible through live transaction feeds. The Trades Feed displays real-time entries and exits from global participants. Each entry shows currency pairs, position sizes, and profit targets—key details for evaluating market sentiment.

Leaderboards rank top performers by monthly returns. Observing these rankings helps identify consistent strategies. A trader dominating GBP/USD trades might reveal patterns in timing or risk management worth emulating.

The Trade Explorer digs deeper into individual performance metrics. Filter results by asset class, win rate, or drawdown details. Historical data shows how strategies perform during volatile periods versus calm markets.

Combining these tools creates a feedback loop. Novices analyze proven trades while veterans benchmark their methods against peers. This ecosystem turns raw data into actionable insights, helping traders refine approaches and boost profitability.