In modern markets, technical analysis tools have become indispensable for decoding price movements and trends. These solutions analyze historical data—like opening and closing values, highs, lows, and volume—to uncover patterns that might otherwise go unnoticed. By processing this information, they help traders make strategic choices aligned with current conditions.

Seasoned market participants rely on these frameworks to pinpoint entry and exit opportunities. Effective risk management often hinges on understanding how price action interacts with broader market dynamics. Tools that translate raw numbers into clear signals enable quicker, more confident decisions.

Selecting the right analytical approach depends on factors like trading style and timeframe. Some methods excel in volatile environments, while others perform better in steady trends. While mastering these techniques requires effort, the payoff comes in sharper forecasting and improved consistency.

This guide examines widely-used strategies that have proven valuable across asset classes. It explains how different methodologies function and their practical applications in real-world scenarios. Readers will discover how to combine data-driven insights with disciplined execution for better outcomes.

Understanding TradingView’s Technical Landscape

Financial markets demand tools that translate complex data into actionable insights. TradingView’s ecosystem delivers this through a versatile interface combining price tracking, pattern recognition, and collaborative features. Whether using free or premium accounts, traders access hundreds of visual tools to dissect market behavior.

- Built-in tools like moving averages and Bollinger Bands

- Custom scripts developed by the Pine Script community

- Real-time synchronization across mobile and desktop

Users layer multiple indicators on a single chart without clutter. This allows comparison between short-term volatility and long-term trends. The cloud-based architecture ensures updates appear instantly across devices, maintaining workflow continuity.

Social features enhance traditional technical analysis. Traders share chart configurations and validate strategies through public discussions. This fusion of individual research and collective wisdom creates a dynamic learning environment for refining market approaches.

Effective navigation relies on understanding three core elements: indicator libraries, timeframe customization, and visualization settings. Mastery of these components helps traders filter noise while focusing on high-probability signals aligned with their risk parameters.

Fundamentals of Technical Analysis on TradingView

Market behavior leaves clues through recurring patterns and measurable forces. Three elements drive this analytical approach: price movement, transaction volume, and market turbulence. Together, they form a language that reveals opportunities hidden in charts.

Reading Market Momentum

Price movements tell stories through candlestick shapes and trendlines. A series of higher lows might signal upward momentum, while broken support levels often precede declines. These patterns emerge across timeframes, from minute charts to monthly perspectives.

Trend strength becomes clearer when analyzing volume spikes. Heavy buying during rallies suggests conviction, while thin participation in price jumps may indicate weak momentum. Combining these observations helps separate sustainable moves from temporary fluctuations.

Measuring Market Energy

Volatility acts as a pressure gauge for financial instruments. High turbulence periods demand wider stop-loss margins, while calm markets allow tighter risk parameters. Tools like average true range (ATR) quantify this energy, helping traders adapt strategies.

Key principles for effective analysis:

- Identify dominant trends using multiple timeframe confirmation

- Validate price breaks with accompanying volume surges

- Adjust position sizes based on current volatility readings

These concepts work best when combined. A trending market with rising volume and moderate volatility often presents high-probability setups. Regular chart review sharpens pattern recognition skills over time.

Exploring best tradingview indicators

Successful traders employ specialized metrics available on TradingView to interpret price movements across financial instruments. Seven core technical indicators stand out for their versatility: RSI, moving averages, MACD, Bollinger Bands, Fibonacci retracement, stochastic oscillator, and volume profile. These solutions fall into three primary categories—momentum oscillators, trend-confirmation systems, and volatility measurements.

Momentum-based tools like RSI highlight overextended market conditions through numerical thresholds. Trend-focused options such as moving averages smooth out noise to reveal directional bias. Volatility indicators including Bollinger Bands adapt to market energy shifts, visually represented on the chart through expanding and contracting lines.

Seasoned analysts often layer multiple indicators to validate signals. Combining a moving average crossover with RSI readings reduces false alarms during choppy markets. This approach creates a feedback loop where different methodologies reinforce each other’s conclusions.

Customization plays a vital role in adapting these tools to specific strategies. Day traders might tighten MACD parameters for quicker signals, while long-term investors extend Fibonacci levels to match broader price trends. Understanding each formula’s mechanics prevents misinterpretation of visual outputs.

Effective implementation requires balancing historical performance with current market analysis. Tools that excelled in trending markets may struggle during consolidation phases. Regular backtesting against various conditions ensures continued relevance in evolving markets.

Mastering Support and Resistance Levels

Market dynamics often hinge on psychological thresholds where buyers and sellers clash. These critical price zones form through repeated historical interactions, creating invisible barriers that influence future movements. Traders who master these patterns gain insight into potential reversals or breakouts.

Identifying Market Turning Points

Support resistance levels emerge where price action stalls or reverses multiple times. Historical data shows clusters of orders accumulate at these zones, reflecting collective market memory. Each retest strengthens their significance, whether they hold or break.

Dynamic levels, like moving averages, adapt to changing conditions. When price trades below a 200-day moving average, it often acts as resistance. Conversely, prices above this line may find temporary support during pullbacks.

- Major zones appear across multiple timeframes

- Breakouts accompanied by volume spikes gain credibility

- False breaks trap overeager traders

Seasoned traders combine these resistance levels with other tools for confirmation. A bounce near historical support paired with bullish candlestick patterns increases confidence. This multi-layered approach filters noise while highlighting high-probability setups.

Effective analysis requires marking key areas on the chart before they’re tested. Proactive planning helps avoid emotional decisions when price approaches these decisive zones. Over time, recognizing these patterns becomes instinctive, sharpening trade timing and risk management.

Decoding Moving Averages and Their Variants

Price charts transform into navigational tools when layered with moving averages. These lines smooth erratic swings, exposing the core direction of market movements. The simple moving average calculates an arithmetic mean over a chosen period, creating a steady reference point for trend identification.

For faster reaction to shifts, the exponential moving average prioritizes recent price action. This weighting helps traders spot reversals earlier than traditional methods. Markets with sudden momentum changes often reveal clearer signals through this adaptive approach.

Volume-weighted variants add another dimension by factoring in trading activity. When heavy transactions accompany price moves, these averages highlight institutional influence. High-volume breakouts gain credibility when confirmed by corresponding line crossovers.

- Short-term traders use 20-period averages for intraday signals

- Long-term investors rely on 200-period lines for trend confirmation

- Crossover systems combine multiple averages to filter false moves

Customization remains crucial. A day trader might track a 9-period EMA alongside a 50-period SMA, while swing traders often pair 50 and 200-day lines. Matching the period length to one’s strategy reduces lag and improves timing accuracy.

These tools thrive when combined with other analysis methods. A rising average price accompanied by increasing volume strengthens conviction in trend continuity. Regular parameter adjustments ensure alignment with evolving market rhythms.

Unveiling the Power of Average Convergence Divergence (MACD)

Momentum analysis becomes clearer through layered data interpretation. The MACD framework combines three visual elements to map energy shifts in price movements. Its core components include the MACD line (12-period vs. 26-period EMA difference), a signal line (9-period EMA smoothing), and a dynamic histogram measuring their relationship.

Signal Line Crossovers Explained

When the MACD line pierces its signal counterpart, traders receive actionable alerts. Upward crosses suggest building bullish energy, while downward passes hint at weakening momentum. These events gain credibility when aligned with price action near support or resistance zones.

Histogram Dynamics Decoded

Bars above the baseline show accelerating trends, while shrinking columns signal potential reversals. Green bars expanding upward confirm buying pressure, whereas red bars dipping below zero often precede sell-offs. Key insight: The histogram’s slope matters more than its absolute value.

- Divergence occurs when prices hit new highs while MACD peaks decline

- Combining crossovers with volume analysis filters false signals

- Adjusting EMA periods adapts the tool to various trading styles

Seasoned analysts use moving average convergence signals alongside other technical factors. This multi-layered approach reduces reliance on single data points. Regular backtesting helps refine interpretation skills for different market phases.

Relative Strength Index (RSI): Gauging Market Momentum

The relative strength index (RSI) acts as a speedometer for price movements. This momentum indicator measures how quickly markets gain or lose steam using a 0-100 scale. Readings above 70 suggest potential exhaustion in buying pressure, while dips below 30 often signal oversold conditions ripe for rebounds.

Traders customize the RSI’s sensitivity by adjusting its calculation period. The default 14-day setting balances responsiveness with reliability. Shorter periods catch quick shifts but may trigger false signals, while longer spans smooth out noise at the cost of delayed alerts.

Divergence patterns reveal hidden opportunities. When prices hit new highs while the RSI peaks lower, momentum often weakens before a reversal. These discrepancies between price action and the strength index help spot trend exhaustion early.

- Combine RSI signals with trendlines for higher accuracy

- Use overbought/oversold thresholds as alerts, not guarantees

- Verify breakouts with volume changes

Range-bound markets amplify the RSI’s effectiveness. Prices often bounce between its upper and lower bounds during consolidation phases. In strong trends, traders wait for the indicator to exit extreme zones before entering positions aligned with the dominant direction.

Advanced users layer multiple RSI settings across timeframes. A 4-hour chart showing oversold conditions paired with a daily RSI uptick strengthens conviction in potential reversals. This multi-scale approach filters noise while respecting broader market context.

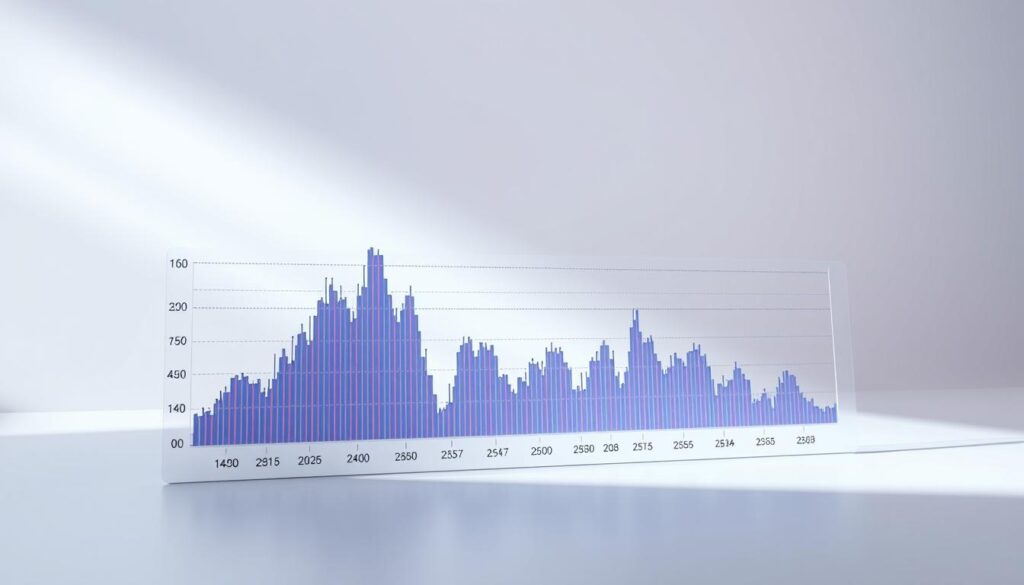

Innovative Volume Profiles and 3D Visualization

Market participation takes new dimensions through advanced visualization techniques. Modern volume profile analysis transforms flat price charts into interactive 3D landscapes. This approach maps trading activity horizontally across price levels, revealing hidden accumulation zones.

Bull vs. Bear Volume Analysis

Colour-coded bars distinguish buyer and seller dominance at specific price points. Green clusters show where bulls aggressively absorbed supply, while red zones highlight bearish control. This split helps traders gauge if breakouts have genuine momentum or face potential rejection.

Identifying Liquidity Clusters and Resistance Zones

Three-dimensional depth makes high-volume areas pop from the chart. These thick horizontal bars act as magnets for future price action. Key features include:

- Point of Control: The price level with heaviest trading activity

- Value Areas: Zones containing 70% of total session volume

- Low-volume gaps: Potential acceleration points during breakouts

When price revisits these clustered zones, reactions often intensify. Thick volume bars suggest strong support or resistance, while thin areas indicate weak commitment. This spatial analysis helps traders anticipate where orders might cluster beyond visible market data.

Advanced Divergence Detection Techniques

Spotting hidden market shifts requires tools that connect price action with trading volume. The CVD Divergence indicator achieves this through cumulative volume delta calculations. It tracks the difference between buy-side (ask) and sell-side (bid) transactions, revealing imbalances before they impact price charts.

Two detection methods refine this analysis. The HTF Sweep approach aligns with higher timeframe order flow for cleaner signals. The All Method casts a wider net, catching subtle momentum shifts during volatile phases. Both techniques help traders anticipate trend reversals earlier than traditional approaches.

Advanced systems scan multiple indicators simultaneously. A robust detector analyzes MACD slopes, RSI thresholds, and volume-weighted momentum readings. This multi-layered verification reduces false signals caused by isolated market noise.

Effective use involves three steps:

- Confirm divergence between price and indicator readings

- Validate signals through volume spikes or candle patterns

- Time entries using supporting technical factors

These techniques transform divergence from a theoretical concept into actionable entry opportunities. By combining volume dynamics with price-energy mismatches, traders gain an edge in anticipating pivotal market turns.